Listeners:

Top listeners:

-

play_arrow

KTSW 89.9

By Jourdan Bazley

Blog Content Contributor

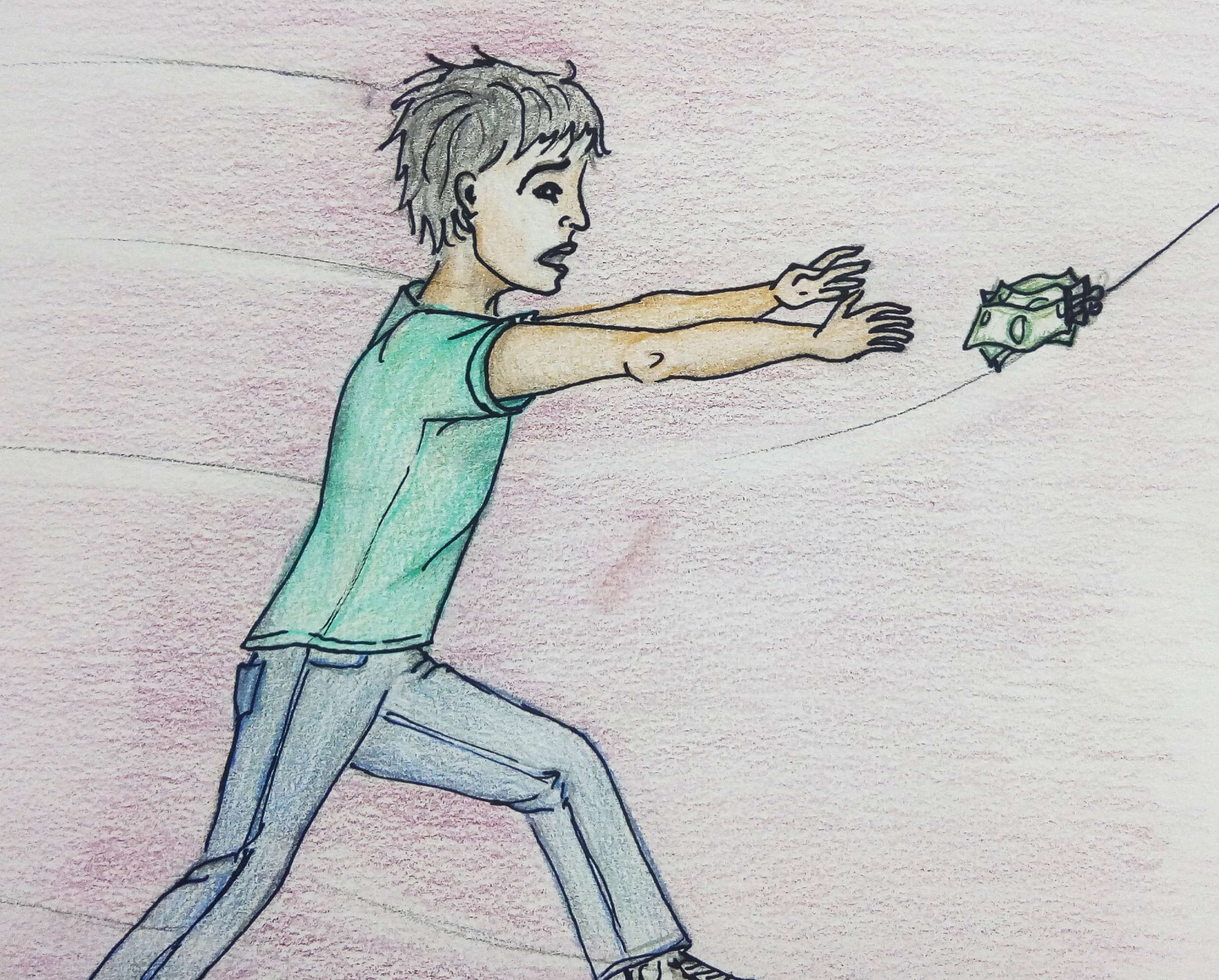

It is the first day of school and you have been through another day of syllabus explanations. Your mind now has the bright idea to celebrate the beginning of another semester by dipping into that valuable refund check that just got cashed in. However, slow down there speed racer. Not all of that money in your bank is necessarily ready to be spent. I know it’s difficult to stop yourself from feeling like you deserve a little celebration to start the semester off right, but instead of spending your dollar bill money, it’s in your best interest to gather your thoughts and focus them on something a bit more important- a budget.

What is a budget exactly? How does one make a budget that can actually be used? A budget is “an estimate of income and expenditure for a set period of time,” or as Urban Dictionary adds, “something that tells you just how broke you really are.” Never mind the fact that you don’t have as much money as you could possibly want as a young adult in you mid-twenties, but that is the point of this entire budget thing. Creating a budget will not only allow you to better control your money, but it will also teach you to save and adjust to spending so that your bank account can result in a leading number followed by multiple zeros.

The first stage to creating a personal budget is to make a list of the things that you know are necessities. Some examples of necessities would be food, books for class, any personal supplies, gas and the cost of living. Once you have separated your wants from your needs, you will need to then equate your income from all of the sources. This could be from your parents, refund check and/or job. By separating all of your necessities from the things that you are wanting, you are allowing yourself to become familiar with what your money must be spent on. With this list of the things that you will need, create a sum total for each portion of your necessities. For example, for the cost of living you would write down $600 per month, for personal items you would write $20 per month, for food maybe you spend $75 and so on and so forth. As you do this, organize your list and create a total amount of money that you will separate from your income for these things alone. Once you have done this, subtract that number from your total and set that part aside for the next step.

This is when the going gets a little bit trickier. You now know what you need to spend money on, but what about all of the things that you try not to let consume your wallet like Starbucks, clothes and shoes, or new activities? This is where you really have to find your focus. With the money leftover after you have separated your needs from your income, you will then need to decide how much money you are willing to spend on things that you don’t really need, but you merely want. I would say it is easier to think of specifics. How much money do you really want to spend on coffee during this semester as a whole; $75? That sounds like a lot of money, but as you swipe your card, these prices add up. Don’t be like me and realize that after the weekend is over you’ve spent about $80 on nonsense.

Place a large sum of money from your left over income directly into your savings and keep this number consistent for each month. Although this may seem tough at first, you have to keep in mind that the money you do not place in your savings may be spent on coffee, midnight tacos or shiny new crop tops and shoes. No, no, that is not how we are living while we are in college. Once you have subtracted an amount for your savings from your left over income, you will then need to find an amount of money that you are willing to spend each month for extras. As a college student, setting aside $50-$60 a month for extra perks is a luxury and should keep you in track with how much you are allowed to spend.

Budgeting your money will save you the scare of logging into your bank account and realizing that you have unleashed the dollar monster on every fast food joint in San Marcos. Take time to control your money, and watch as you create a better way of spending and a less stressful habit of life.

Feature illustration by Ana Cobos.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to print (Opens in new window)

Ana Cobos Budgeting Jourdan Bazley Money Saving Spending

Similar posts

This Blog is Propery of KTSW

Post comments (0)